Description

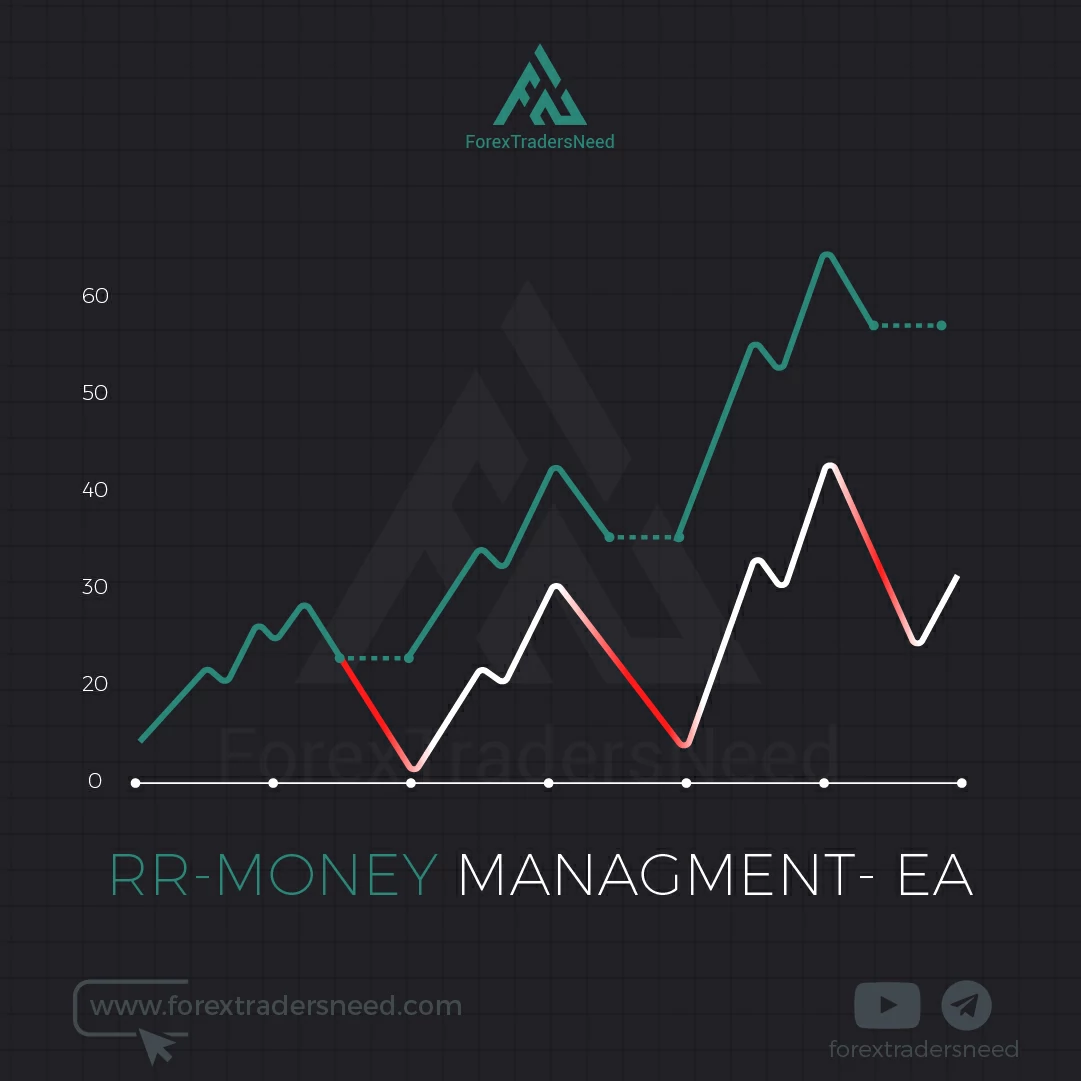

this is also referred to as the standard position sizing approach. In this approach, the trader determines the percentage level of the balance left in his account that can be risked in each transaction. Often, the value in percentage falls within 1% to 3%. Thus, the account’s magnitude depends on the percentage risk size.

For instance, if one transacts with $11 000, you might risk $1100 per transaction. Perhaps per transaction, the level of risk increases by one unit in percentage.

Hence, ending the transaction resulted in a loss of $1100. The main challenge of this approach is that the same quantity is apportioned to every Broker. Thereby, graphically, the account is smoother and more stable.

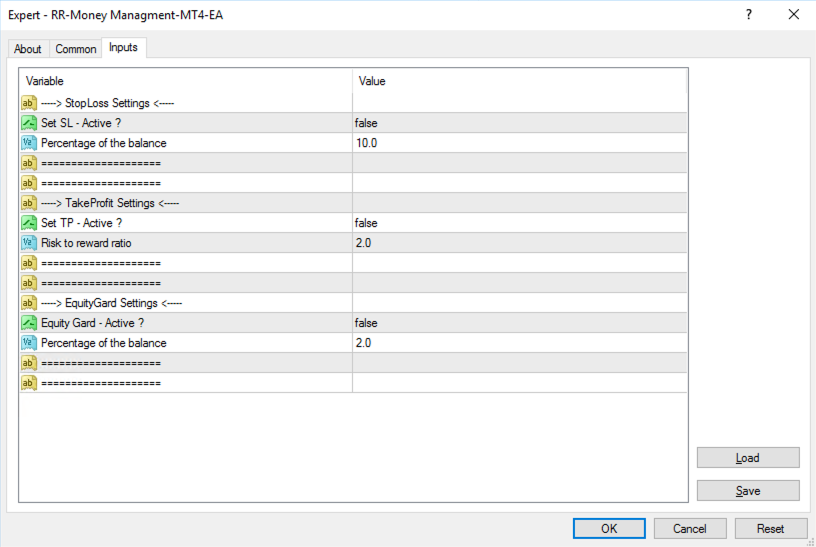

- position size

- SL-TP

- R=R

- Manage Your Account

Only logged in customers who have purchased this product may leave a review.

Reviews

There are no reviews yet.